dinas-vl.ru Community

Community

Cost Of Points On A Loan

The number of discount points you need to receive the lower rate. Each point costs 1% of your mortgage amount. Information and interactive calculators are made. One point typically equals 1% of the loan amount. For example, one point on a $, loan would cost you $4, ($, x ). Generally speaking. But each point will cost 1 percent of your mortgage balance. This mortgage points calculator helps determine if you should pay for points or use the money to. Points are an amount paid to the mortgage lender at closing used to lower the interest rate. One point is equal to one percent of the loan amount (for example. Reduced rates may be available through the purchase of "points". The cost of a point is equal to 1% of the loan amount. For most products, one point will. Loan points, also called mortgage points or discount points, provide a way for borrowers to pay more in closing costs up front in exchange for a lower interest. Typically, one point costs 1% of the total mortgage, and permanently lowers the interest rate anywhere from % to %, depending on the type of mortgage. Typically each point costs 1% of the amount financed. If you finance a $, mortgage then 2 points would cost you $8, Each point you buy typically. A mortgage point equals 1 percent of your total loan amount — for example, on a $, loan, one point would be $1, Mortgage points are essentially a. The number of discount points you need to receive the lower rate. Each point costs 1% of your mortgage amount. Information and interactive calculators are made. One point typically equals 1% of the loan amount. For example, one point on a $, loan would cost you $4, ($, x ). Generally speaking. But each point will cost 1 percent of your mortgage balance. This mortgage points calculator helps determine if you should pay for points or use the money to. Points are an amount paid to the mortgage lender at closing used to lower the interest rate. One point is equal to one percent of the loan amount (for example. Reduced rates may be available through the purchase of "points". The cost of a point is equal to 1% of the loan amount. For most products, one point will. Loan points, also called mortgage points or discount points, provide a way for borrowers to pay more in closing costs up front in exchange for a lower interest. Typically, one point costs 1% of the total mortgage, and permanently lowers the interest rate anywhere from % to %, depending on the type of mortgage. Typically each point costs 1% of the amount financed. If you finance a $, mortgage then 2 points would cost you $8, Each point you buy typically. A mortgage point equals 1 percent of your total loan amount — for example, on a $, loan, one point would be $1, Mortgage points are essentially a.

Summary of When You Might Want to Pay Mortgage Points · You want to pay less interest over the loan's entire term. · You plan to keep your home (and not refinance). Discount points are always used to buy down the interest rates, while origination fees sometimes are fees the lender charges for the loan or sometimes just. Point charges up to a % processing fee (subject to a $1, minimum) and other third party paid closing costs such as appraisal, escrow, and government fees. The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different. Each point you buy costs 1 percent of your total loan amount. Unlike interest rates, APR factors in the amount borrowed, the interest rate, points, one-time fees, and discounts to determine a more accurate yearly cost. The. Technically, there are no VA maximum discount points for such loans. However, the exact number of points you can buy is ultimately up to the lender handling. Buying points when you close your mortgage can reduce its interest rate, which in turn reduces your monthly payment. But each 'point' will cost you 1% of your. Essentially, when a mortgage broker or mortgage lender says they're charging you one point, they simply mean 1% of your loan amount, whatever that might be. How. The number of discount points you need to receive the lower rate. Each point costs 1% of your mortgage amount. Information and interactive calculators are made. "Points," also called, loan discount or discount points, describe costs which are a form of prepaid interest. Each mortgage discount point paid lowers the. Each point costs 1% of the loan amount and lowers the interest rate typically by % (though this percentage may vary by lender). You decide whether you want. Buying mortgage points can be an effective way to lower your monthly payments, but if you don't plan ahead, you may not break even. See why. Two points will cost you $4, You get the idea. And this is on top of closing costs. If paying for points would leave you short on cash for necessities, or. In most cases, one point is equivalent to 1% of the total loan amount. For example, if a buyer wanted to purchase a home with a $, loan, one discount. Each discount point generally costs 1% of the total loan and lowers the loan's interest rate by one-eighth to one-quarter of a percent. Points can sometimes be. Here's how discount points work. One discount point costs 1% of your loan amount. While one point will typically reduce the interest rate by less than 1%, even. You may have heard the term “points” or “mortgage points” when loan shopping. Essentially, a point is an amount taken off of your loan (typically percent). Mortgage origination points also cost approximately 1% of the loan amount. This fee can be negotiated with the lender if you have a good income and credit score. Buying mortgage points can be an effective way to lower your monthly payments, but if you don't plan ahead, you may not break even. See why.

Rogers Commodity Index

The Rogers International Commodity index (RICI) is a broad commodities index that tracks commodities. The index composition is dependent on the global. The ETF tracks the Rogers International Commodity Index® (RICIGLTR), a US dollar-denominated total return index of commodities consumed in the global economy. Find the latest ELEMENTS Linked to the Rogers International Commodity Index - Total Return (RJI) stock quote, history, news and other vital information to. Market Access Rogers International Commodity Index UCITS ETF Cap ; Reference Data. ISIN, LU Valor Number ; Fund Prices. Current Price *, EUR. AB Svensk Ekportkredit ELEMENTS Linked to the Rogers International Commodity Index-Energy Total Return (RJN) Overview. Read detailed company information. Learn more about Rogers International Commodity Index - Agriculture Total Return ETFs including comprehensive lists, performance, dividends, holdings. The index was developed by Jim Rogers to be an effective measure of the price action of raw materials on a worldwide basis. Beeland Interests, Inc. is the owner and sponsor of the Rogers International Commodity Index® (also known as the RICI®). The Index represents the value of a basket of futures contracts on commodities consumed in the global economy, ranging from agricultural to energy and metals. The Rogers International Commodity index (RICI) is a broad commodities index that tracks commodities. The index composition is dependent on the global. The ETF tracks the Rogers International Commodity Index® (RICIGLTR), a US dollar-denominated total return index of commodities consumed in the global economy. Find the latest ELEMENTS Linked to the Rogers International Commodity Index - Total Return (RJI) stock quote, history, news and other vital information to. Market Access Rogers International Commodity Index UCITS ETF Cap ; Reference Data. ISIN, LU Valor Number ; Fund Prices. Current Price *, EUR. AB Svensk Ekportkredit ELEMENTS Linked to the Rogers International Commodity Index-Energy Total Return (RJN) Overview. Read detailed company information. Learn more about Rogers International Commodity Index - Agriculture Total Return ETFs including comprehensive lists, performance, dividends, holdings. The index was developed by Jim Rogers to be an effective measure of the price action of raw materials on a worldwide basis. Beeland Interests, Inc. is the owner and sponsor of the Rogers International Commodity Index® (also known as the RICI®). The Index represents the value of a basket of futures contracts on commodities consumed in the global economy, ranging from agricultural to energy and metals.

The latest Market Access (RICI) Rogers International Commodity Index UCITS ETF share price (RICI). View recent trades and share price information for Market. Linked to. The Rogers International Commodity Index® —Total ReturnSM (RICI® – Total Return ELEMENTS). RICI® -Total Return ELEMENTS are designed to track the. Get Market Access Rogers International Commodity Index UCITS ETF (MRIC:Swiss Exchange) real-time stock quotes, news, price and financial information from. The RICI Metals Index (RICI-M) is a long-only, unleveraged investment in the 10 metals components of the Rogers International Commodity Index(R) "RICI,". The Rogers International Commodity Index (RICI) is a broad index of commodity futures designed by Jim Rogers in / The first fund tracking the index. The Rogers International Commodity Index (RICI) is a broad index of commodity futures designed by Jim Rogers in / The first fund tracking the index. Market Access Rogers International Commodity Index ETF advanced ETF charts by MarketWatch. View M9SA exchange traded fund data and compare to other ETFs. Find the latest Market Access Rogers International Commodity Index UCITS ETF (RICI.L) stock quote, history, news and other vital information to help you. Complete Market Access Rogers International Commodity Index ETF funds overview by Barron's. View the RICI funds market news. Get Market Access Rogers International Commodity Index UCITS ETF (RICI-GB:London Stock Exchange) real-time stock quotes, news, price and financial. The Rogers International Commodity Index Committee reviews the selection and weighting of the futures contracts in the RICI – Total Return Index and the RICI-. Rogers International Commodity offers exposure to a diversified basket of stocks, which can be appealing for investors seeking broad market exposure. Market Access Jim Rogers International Commodity Index ETF price in real-time (A0JK68 / LU) charts and analyses, news, key data, turnovers. See all ETFs tracking the Rogers International Commodity Index - Agriculture Total Return, including the cheapest and the most popular among them. Compa. ELEMENTSSM Linked to the Rogers International Commodity Index - Total ReturnSM (RJI). ELEMENTS are exchange-traded notes designed to track the return of a. Performance charts for Diapason Rogers Commodity Index Fund (DIAPASC) including intraday, historical and comparison charts, technical analysis and trend. ELEMENTS Linked to the Rogers International Commodity Index - Agriculture Total Return (RJA). NYSE. Currency in USD. Disclaimer. Add to Watchlist. Get the latest Elements Rogers International Commodity Index-Metals Total Return ETN (RJZ) fund price, news, buy or sell recommendation, and investing. RICI | A complete Market Access Rogers International Commodity Index ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news. Get the latest Elements Rogers International Commodity Index-Total Return ETN (RJI) fund price, news, buy or sell recommendation, and investing advice from.

Return On Equity

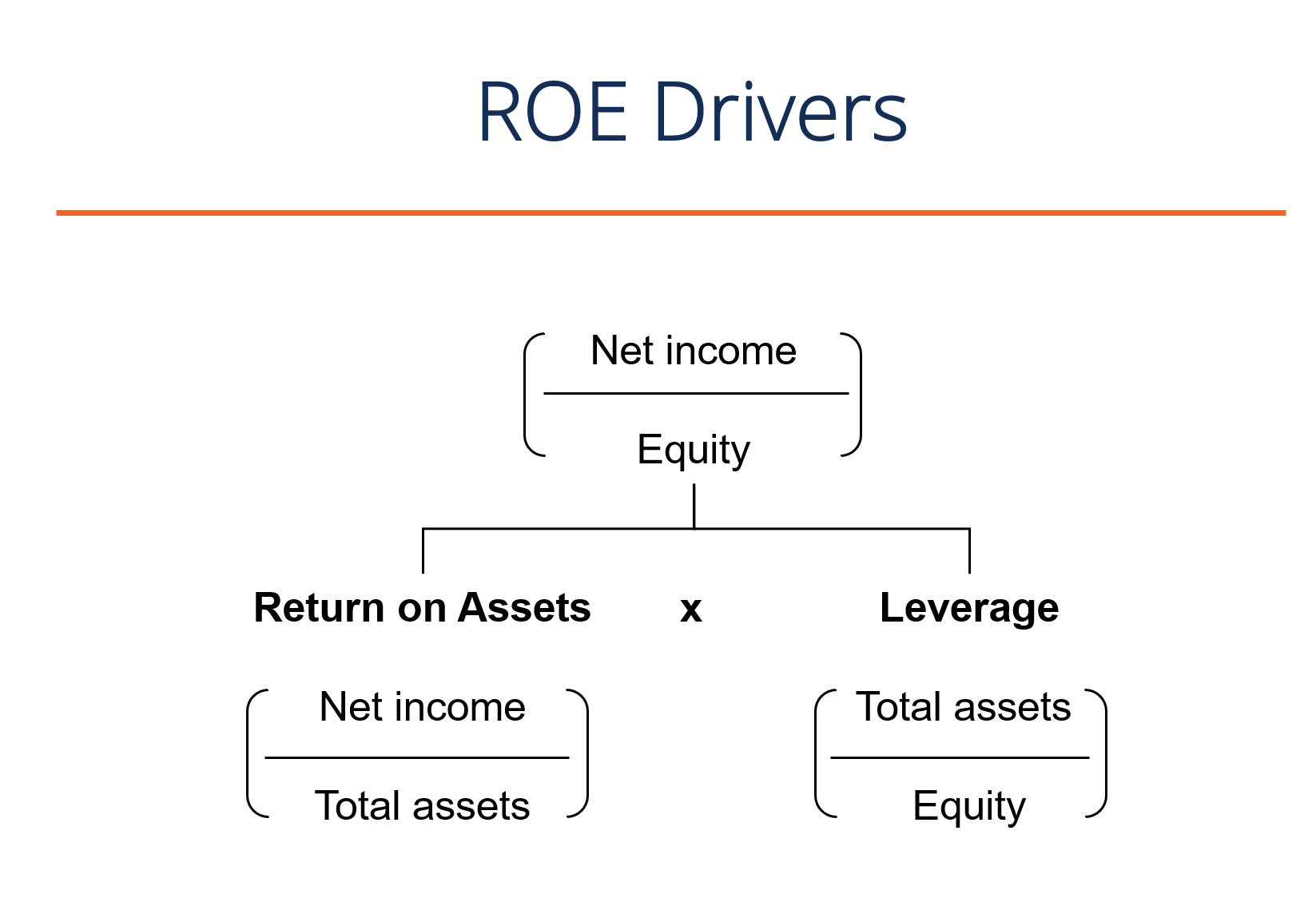

When net income is negative the resulting percentage is negative, which is always considered bad. If both net income and equity are negative the resulting ratio. What is ROE? ROE stands for "Return on Equity." It is a financial ratio that measures how much profit a company generates with the money invested by its. The return on equity (ROE) is a measure of the profitability of a business in relation to its equity; where: ROE = Net Income/Average Shareholders' Equity. Return on Equity, or ROE, is a metric that measures a particular company's profitability. It specifically shows the business's net income, or annual return. Return on Equity (ROE) is the measure of a company's annual return (net income) divided by the value of its total shareholders' equity, expressed as a. Return on equity, also known as ROE, is a ratio of net profit divided by equity. Investors use this ratio to determine how profitable an investment is. This. Return on equity is a measure of your company's net income divided by shareholder equity, expressed as a percentage. In other words, it reveals how much net . ROE measures a company's profitability by comparing net income to shareholder equity. Return on equity can show how efficiently a company is using shareholder. Return on equity is a reliable means of quantifying your startup's annual return – or net income – which is divided by your shareholder's income or equity. When net income is negative the resulting percentage is negative, which is always considered bad. If both net income and equity are negative the resulting ratio. What is ROE? ROE stands for "Return on Equity." It is a financial ratio that measures how much profit a company generates with the money invested by its. The return on equity (ROE) is a measure of the profitability of a business in relation to its equity; where: ROE = Net Income/Average Shareholders' Equity. Return on Equity, or ROE, is a metric that measures a particular company's profitability. It specifically shows the business's net income, or annual return. Return on Equity (ROE) is the measure of a company's annual return (net income) divided by the value of its total shareholders' equity, expressed as a. Return on equity, also known as ROE, is a ratio of net profit divided by equity. Investors use this ratio to determine how profitable an investment is. This. Return on equity is a measure of your company's net income divided by shareholder equity, expressed as a percentage. In other words, it reveals how much net . ROE measures a company's profitability by comparing net income to shareholder equity. Return on equity can show how efficiently a company is using shareholder. Return on equity is a reliable means of quantifying your startup's annual return – or net income – which is divided by your shareholder's income or equity.

Return on Equity by Sector (US) ; Brokerage & Investment Banking, 27, %, % ; Building Materials, 44, %, %. Return on Equity. Return on equity (ROE) is a useful metric for calculating a company's financial performance. It is calculated by dividing net income by. Return on equity indicates how well a company is doing with the money it has now, whereas return on capital indicates how well it will do with further capital. Return on equity (ROE) is a measure of a company's financial performance. It is calculated by dividing net income by shareholders' equity. The return on equity ratio is calculated by dividing earnings after tax (EAT) by shareholders' equity. The mathematical formula is as follows. The return on equity ratio is calculated by dividing earnings after tax (EAT) by shareholders' equity. The mathematical formula is as follows. ROE is an exceptionally popular measure with publicly held companies. It answers the question, “what rate of return is the company producing for its owners?”. ROE tells you about the financial soundness of a company – strength of its financial and organisational framework. If a company boasts a higher return on equity. The Return on Equity (ROE) is a ratio that assesses the effectiveness of the funds invested by companies' shareholders. The Return on Equity Formula. The RoE is the net income from the firm's most recent income statement, divided by the total equity at the end of the period. The. Return on Equity (ROE) (Actual and Authorized) The amount of profit authorized or actually returned to shareholders as a percentage of shareholders equity. Return on equity (ROE) is a metric for the annual percentage return earned on shareholders' equity. Calculate ROE as net income divided by average shareholders'. The ROE is set so that the return is sufficient to attract the capital needed for the utility to construct and maintain a safe and reliable system while not. At Jensen Investment Management, we believe that Return on Equity (ROE) is a very useful criterion for identifying companies that have the potential to. Examples of return on equity (ROE). The calculation for return on equity is: ROE = Net Income/Average Shareholders' Equity. When applying the ROE formula, it's. YCharts uses trailing 12 month net income and average of past five quarters of book value of shareholder's equity when calculating ROE. This differs from the. Return on equity is a ratio you can use to measure the financial performance of a company based on its shareholders' equity. Return on equity is a measure of financial performance within a business. It is calculated by dividing net income by shareholders equity. A company's Return on Equity (ROE) is a financial ratio calculated by dividing its net income by its average shareholders' equity. Return on Equity (ROE) is a ratio used by investors who want to invest in a company for the long term, as opposed to those looking for the next hot stock.

Can You Buy Crypto With Capital One Credit Card

How do I buy Crypto Capital One?In short, to buy crypto Capital One, investors in the US will need to sign up with a FINRA-regulated crypto exchange like. 8. Can I use all my balance to buy or sell cryptocurrency? Capital One won't allow its credit card customers to make cryptocurrency purchases, but said the policy may change. Should I Buy Cryptocurrency Using Credit Cards? · The fees involved may be higher · Buying and selling process may take longer than alternatives · Credit cards. I can't seem to purchase it with Capital One card. My TD visa is fine but when I tried capital One it got rejected. Also I am in Canada. You can instantly purchase a range of cryptocurrencies using your Visa and Mastercard. Withdrawal hold. As a security precaution, withdrawals in. Digital wallets & mobile payments. Add your Capital One card to a digital wallet for fast, secure payments. Not sure if a credit card is right for you? A Visa prepaid card could be the way to go. Its a more secure, convenient solution to everyday spending. Chase, Capital One and Citi all allow you to buy crypto with one of their cards. Even American Express allows it, although no U.S.-based exchanges currently. How do I buy Crypto Capital One?In short, to buy crypto Capital One, investors in the US will need to sign up with a FINRA-regulated crypto exchange like. 8. Can I use all my balance to buy or sell cryptocurrency? Capital One won't allow its credit card customers to make cryptocurrency purchases, but said the policy may change. Should I Buy Cryptocurrency Using Credit Cards? · The fees involved may be higher · Buying and selling process may take longer than alternatives · Credit cards. I can't seem to purchase it with Capital One card. My TD visa is fine but when I tried capital One it got rejected. Also I am in Canada. You can instantly purchase a range of cryptocurrencies using your Visa and Mastercard. Withdrawal hold. As a security precaution, withdrawals in. Digital wallets & mobile payments. Add your Capital One card to a digital wallet for fast, secure payments. Not sure if a credit card is right for you? A Visa prepaid card could be the way to go. Its a more secure, convenient solution to everyday spending. Chase, Capital One and Citi all allow you to buy crypto with one of their cards. Even American Express allows it, although no U.S.-based exchanges currently.

When you buy, exchange or sell crypto assets, each transaction appears on a blockchain. The growing list of records, called blocks, are linked to one another. Unlock seamless Bitcoin purchases with Trust Wallet. Choose from a range of easy payment options including debit and credit cards, mobile payments, and bank. If you decide to buy Bitcoin with a debit card you will notice that it is incredibly straightforward. · A bitcoin purchase by debit card also alleviates the need. In addition to using a Fiat Wallet or credit/debit card, users can buy crypto with Apple Pay, Google Pay, and other cryptocurrencies in the dinas-vl.ru App. Here's a list of credit card providers that don't allow cardholders to purchase crypto. Bank of America; Barclays; Capital One; Chase; Citibank; Discover; TD. Even though Capital One doesn't offer Crypto directly, they won't actually prevent you from buying it — they just don't want to be personally. you will recognize a capital gain or loss. For more information on You have received the cryptocurrency when you can transfer, sell, exchange. Capital One Quicksilver Secured Cash Rewards Credit Card · No annual or hidden fees, and you can earn unlimited % cash back on every purchase, every day. · Put. You will be unable to access your candidate portal or apply during this time. You can 'pin' a job under your job search results, and revisit it once service. Bitcoin is the gold standard for cryptocurrencies and the go-to starter crypto for most beginners. And now, you can buy Bitcoin instantly using your bank's. Capital One users can link their credit card or debit card to their digital wallets to make on-the-go purchases faster and more securely. Try a more secure way. Enjoy VIP packages, athlete meet-and-greets and more. As the official bank and credit card partner of the NCAA, you can be a part of every can't miss moment. I help you track your spending by monitoring your credit card account and Eno can create virtual card numbers when you shop online from your desktop computer. First, restrictions may be in place on the payment network you're using. One good example is Mastercard, which treats crypto purchases as cash advances. As such. You can buy Bitcoin and crypto in Exodus with various payment methods, including debit card, credit card, bank account, PayPal, Apple Pay, or Google Pay. ChangeNOW is one of the most popular platforms for trading cryptocurrency. You can use it to purchase Bitcoin with your credit/debit card, and you don't even. Earn cash rewards on every purchase, everywhere when you use your Quicksilver cash back credit card from Capital One. Visa Credit Cards · Visa Debit Cards Visa's crypto solutions and capabilities can help you evaluate and capitalize on the growing interest in crypto. Pay with your Capital One rewards when you check out with PayPal. You can use your Capital One credit card rewards at millions of online stores. Currently, Capital One relies on the Visa and MasterCard networks for payment processing, but it plans to move all of its debit cards and some of its credit.

Fraud And Identity Theft Protection

Starting at $ per month, get award-winning identity theft protection from a provider with 19 years experience. Our enhanced identity theft protection insurance helps guard against identity theft through full prevention, detection, and resolution services. Credit profile. LifeLock monitors for identity theft and threats. Sign up with one of the most trusted identity theft protection providers to help safeguard your credit. If you become a victim of identity fraud, Travelers' identity fraud expense reimbursement coverage can cover expense reimbursements up to $25,, with no. Protect your community by reporting fraud, scams, and bad business practices. Report fraud. Get. MetLife Identity & Fraud Protection powered by Aura helps safeguard the things that matter to you most: your identity, money and assets, family, reputation. #1 Identity Guard – Best Identity Theft Protection Service ; #2 ID Watchdog – Good Financial Monitoring Features ; #2 Aura — Best for Comprehensive Protection. How to Protect Yourself from Identity Theft · Use a locking mailbox to prevent mail theft. · Be wary of e-mail scams. If you did not enter an international. Better identity theft protection and fraud detection for you and your family, with advanced alerting, and credit lock to prevent unauthorized inquiries. Starting at $ per month, get award-winning identity theft protection from a provider with 19 years experience. Our enhanced identity theft protection insurance helps guard against identity theft through full prevention, detection, and resolution services. Credit profile. LifeLock monitors for identity theft and threats. Sign up with one of the most trusted identity theft protection providers to help safeguard your credit. If you become a victim of identity fraud, Travelers' identity fraud expense reimbursement coverage can cover expense reimbursements up to $25,, with no. Protect your community by reporting fraud, scams, and bad business practices. Report fraud. Get. MetLife Identity & Fraud Protection powered by Aura helps safeguard the things that matter to you most: your identity, money and assets, family, reputation. #1 Identity Guard – Best Identity Theft Protection Service ; #2 ID Watchdog – Good Financial Monitoring Features ; #2 Aura — Best for Comprehensive Protection. How to Protect Yourself from Identity Theft · Use a locking mailbox to prevent mail theft. · Be wary of e-mail scams. If you did not enter an international. Better identity theft protection and fraud detection for you and your family, with advanced alerting, and credit lock to prevent unauthorized inquiries.

Top 10 Tips for Identity Theft Protection · 1. Protect your Social Security number. · 2. Fight "phishing" - don't take the bait. · 3. Polish your password. Powerful identity protection from ProtectMyID ®, a brand you trust victims were affected by traditional identity fraud in was the average amount of. to obtain a credit report. Contact any of the credit reporting agencies to place a fraud alert on your file: Experian: dinas-vl.ru or ID theft protection Protect your credit and your good name. For only $45 a year (less than $4 a month), Nationwide's identity theft protection helps you. ID theft can happen to anyone · 1. Keep your personal information secure · 2. Protect your devices · 3. Control access to your accounts. Advanced Fraud Monitoring · 3-Bureau Credit Monitoring · Additional Monitoring Included: Name, Address & Social Media Identity; Sex Offender Registry & Criminal. Powerful identity protection from ProtectMyID ®, a brand you trust victims were affected by traditional identity fraud in was the average amount of. Identity theft can happen to anyone, but you can reduce the risk of becoming a victim by taking some simple steps to protect your personal information. Our enhanced identity theft protection insurance helps guard against identity theft through full prevention, detection, and resolution services. Credit profile. An identity theft protection program monitors your credit reports, online debit/credit card number(s) and Social Security number. Our program offers up to $1,, ($2,, on family plans) to cover any funds stolen from you, along with reimbursement for expenses incurred due to an ID. Visit dinas-vl.ru for prevention tips and free resources to share in your community. Privacy Policy. OMB CONTROL#: Under the Paperwork Reduction. Secure your information now to avoid identity theft later. · Credit Monitoring · Dedicated Experts · CyberScan™ · Exclusive Information · ID Theft Insurance · Alerts. While it is hard to prevent identity theft, it's important to remember several guidelines to protect yourself and your VA benefits from identity theft and fraud. With Advanced Fraud Monitoring, you are promptly notified if your identity is used to apply for a new credit card, wireless device, utility payments, check. Recovering from Identity Theft Is someone using your personal information to open accounts, file taxes, or make purchases? Visit dinas-vl.ru, the. to obtain a credit report. Contact any of the credit reporting agencies to place a fraud alert on your file: Experian: dinas-vl.ru or The identity theft insurance included with your Aura plan provides: Stolen funds reimbursement: If your money is stolen due to identity theft, you may be. 24/7 identity monitoring and alerts, plus up to $2 million in identity theft coverage, for greater peace of mind. AI-powered security on unlimited devices. 1. Close accounts with fraudulent activity or fraudulently opened accounts. · Contact the issuer's security or fraud department for next steps. If mailing.

Robinhood Mini Options

View the basic HOOD option chain and compare options of Robinhood Markets, Inc. on Yahoo Finance. Other posts · Robin Hood's Stock Market · Stock Market Traders. · Day Trading Stocks and Opt · ROBINHOOD STOCK TRADE · Robinhood Stock &. Our Options Knowledge Center explains terminology, basic and advanced trading strategies, and how to place an options trade on Robinhood. View the real-time SPY price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. You'll need a broker to trade futures contracts. Unfortunately, you currently can't YOLO into a 20 lot of ESM3 using your Robinhood app on your. Invest in stocks, ETFs, cryptocurrency, and more. Investors, say goodbye to transaction fees. With Robinhood you can place trades on Nasdaq and the NYSE. This stock is no longer active on Robinhood. Sign up for a Robinhood brokerage account to watch Mobile Mini and buy and sell other stock and options commission-. Step 1: · Step 2: Fund your Robinhood account: · Step 3: Log in to your Robinhood account. · Step 4: Enable option trading. · Step 5: Select options and complete. dinas-vl.ru, which was founded in , is a brokerage firm that provides commission-free trades in stocks, bond options, and ETFs (Exchange Traded Funds). View the basic HOOD option chain and compare options of Robinhood Markets, Inc. on Yahoo Finance. Other posts · Robin Hood's Stock Market · Stock Market Traders. · Day Trading Stocks and Opt · ROBINHOOD STOCK TRADE · Robinhood Stock &. Our Options Knowledge Center explains terminology, basic and advanced trading strategies, and how to place an options trade on Robinhood. View the real-time SPY price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. You'll need a broker to trade futures contracts. Unfortunately, you currently can't YOLO into a 20 lot of ESM3 using your Robinhood app on your. Invest in stocks, ETFs, cryptocurrency, and more. Investors, say goodbye to transaction fees. With Robinhood you can place trades on Nasdaq and the NYSE. This stock is no longer active on Robinhood. Sign up for a Robinhood brokerage account to watch Mobile Mini and buy and sell other stock and options commission-. Step 1: · Step 2: Fund your Robinhood account: · Step 3: Log in to your Robinhood account. · Step 4: Enable option trading. · Step 5: Select options and complete. dinas-vl.ru, which was founded in , is a brokerage firm that provides commission-free trades in stocks, bond options, and ETFs (Exchange Traded Funds).

Robinhood penny stocks trade at $5 or less per share, and they hold opportunities for traders building small accounts. These stocks are cheap and often sketchy. According to the complaint, "68% of Massachusetts-based Robinhood customers were approved for options trading after reporting limited or no investing experience. A Robinhood trading strategy refers to the strategies of clients of the brokerage. By enabling commission-free trading of stocks, options, and cryptocurrencies. Upon opening the main trading screen on the Robinhood App, an investor faces a par- ticular set of default order options. After designating a trade quantity in. Mini options, also known as E-mini options, are exchange-traded options contracts that are a fraction of the value of a corresponding standard options contract. Abstract · 21 · dollar in the average customer account, Robinhood users traded nine times and 40 times as · users also traded options contracts 88 times more than. Robinhood, to talk options education, 24hr trading, and more Mini Episode RobinHood isn't all it's cracked up to be, and. It is as if there is a mini-book on how options work right within the app. trade options on robinhood stock market stock trading investing I am not a fan of. Cboe Options Exchange has extended global trading hours (GTH) for S&P ® Index (SPX) options, Cboe Volatility Index® (VIX) options and Mini-SPX Index (XSP). Users can invest in stocks, crypto, exchange-traded funds (ETFs), American depository receipts (ADRs), and options. Since its initial launch, Robinhood has. Mini options are an options class that carries 10 shares of an underlying Robinhood · Trade Ideas · Benzinga · Sterling · DAS Trader · eSignal. Quotes. Apple. Fractional shares are pieces, or fractions, of whole shares of a company or ETF. Since Robinhood Financial offers Fractional Shares, you can trade stocks. Stocks Option prices for Robinhood Markets Inc Cl A with option quotes and option chains. Wheel Strategy Mini Course (How To Trade Options). Brad Cash Secure Put Options Explained | How To Trade & Sell Options On Robinhood. Benefits of XSP Index Options · Mini Contract: Greater flexibility with smaller contracts. · Cash Settlement: Trading account credited/debited in cash, no. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Buy Loungefly Disney Mini Backpack, Classic Robin Hood and other Casual Daypacks at dinas-vl.ru Our wide selection is eligible for free shipping and free. Why choose Robinhood ; Minimum deposit. $0 ; Stock fee. Low ; Options fee. Low ; Account opening. 1 day. Investing with a Robinhood investing account is commission free. We don't charge you fees to open or maintain your account. Futures and futures options trading services provided by Charles Schwab Futures and Forex LLC. Trading privileges subject to review and approval. Not all.

Huobi Sign Up Bonus

Huobi Global to offer users an alternative investment option, in the form of a welcome bonus campaign, where users stand to win rewards worth up to USDT. Bonus: Get up to a $ USDT welcome bonus by completing several tasks. How to get: Open a new account and meet the following tasks: Sign Up to get Registration Bonus: Win up to USDT by signing up. KYC Bonus: Win up to USDT by completing L1 KYC Verification. Deposit Bonus: Win up to USDT by. You can share insights and advice anonymously with Huobi employees and get real answers from people on the inside. Ask a question. Join the Huobi team. GET UP TO $ IN SIGN-UP BONUS. Exchange Fees. Withdrawal Fee • Taker OFFER: If you sign up to Huobi using this link, you can receive up to. Stream Huobi Promo Code | Huobi Global Sign Up Bonus | Code: 2yn8a | BestCoinShare✓ by Share Best Coin on desktop and mobile. Huobi Global provide secure,stable and reliable digital asset trading and Act before your offer ends! You've earned $0. Get up to $ Rules Point card. How does Huobi Referral Code & Signup Bonus work? Go to Huobi's registration page. Register an account (Enter the referral code. How to get $ on Huobi Global? You can get $ on Huobi Global by taking part in the Crypto Welcome Bonus Campaigns. This is a special offer for new users. Huobi Global to offer users an alternative investment option, in the form of a welcome bonus campaign, where users stand to win rewards worth up to USDT. Bonus: Get up to a $ USDT welcome bonus by completing several tasks. How to get: Open a new account and meet the following tasks: Sign Up to get Registration Bonus: Win up to USDT by signing up. KYC Bonus: Win up to USDT by completing L1 KYC Verification. Deposit Bonus: Win up to USDT by. You can share insights and advice anonymously with Huobi employees and get real answers from people on the inside. Ask a question. Join the Huobi team. GET UP TO $ IN SIGN-UP BONUS. Exchange Fees. Withdrawal Fee • Taker OFFER: If you sign up to Huobi using this link, you can receive up to. Stream Huobi Promo Code | Huobi Global Sign Up Bonus | Code: 2yn8a | BestCoinShare✓ by Share Best Coin on desktop and mobile. Huobi Global provide secure,stable and reliable digital asset trading and Act before your offer ends! You've earned $0. Get up to $ Rules Point card. How does Huobi Referral Code & Signup Bonus work? Go to Huobi's registration page. Register an account (Enter the referral code. How to get $ on Huobi Global? You can get $ on Huobi Global by taking part in the Crypto Welcome Bonus Campaigns. This is a special offer for new users.

Sign up on Huobi Global today and earn upto USDT as welcome bonus! In order to provide a measure of positivity amidst the current gloom, Huobi Global is now launching exclusive benefits for new users: register. Sign Up Bonus. Learn to Make Honest Money Online · $ Bybit Bonus HUOBI GLOBAL $ BONUS: How to Get Huobi Welcome Bonus? (). Learn to. Sign up on Huobi exchange and create an account with the Invitation Code – USDT Welcome Bonus (earned by completing tasks in the Reward Hub). New users can get up to a $ Huobi Welcome Bonus – Register to get a $20 USD bonus from the Huobi to start your crypto trading live with no cost. Spotlight on Huobi: How to Register and Get Started on Huobi (% Powered-up) sign up bonus when you complete the tasks). Clicking on that link takes you. [Exclusive] Make a Move With Up To USDT Welcome Bonus! Such instability has led exchanges such as Huobi Global to offer users an. Welcome to huobi Global New Users Get up to USDT Welcome Bonus. Sign up now! Sign up on HTX to earn cash rewards! Your friend ** is inviting you to join HTX. Email Mobile. Email. Password. show password. Verification code. One of the world's leading cryptocurrency exchanges Huobi Global has recently announced that it offers a $ sign-up bonus for the new users of Huobi Global. Huobi Global's New Users Can Enjoy $ Sign-up Bonus · Participants of the “Welcome Bonus” should be only new users. · Users must finish the new user tasks. Starting today, your friends who sign up on HTX through your invitation link will receive a 50% discount on trading fees for up to 30 days and a Welcome Bonus. Bonus Summary Huobi Welcome no deposit crypto bonus is a limited-time promotion for the new user of the company. The campaign brings some tasks to complete. Welcome Bonus. Sign up with Huobi and get a USDT welcome bonus! checked. Explore More Benefits. Cadydrop Daily: , USDT. HuobiEarn Weekly: UP TO %. HUOBI GLOBAL REFERRAL CODE: pztn to Earn up to $ USDT Welcome Bonus sign-up bonus (tasks) XA4AYRV1. 2 upvotes · 2 comments. r. Welcome to huobi Global New Users Get up to USDT Welcome Bonus. Sign up now! welcome-bonus/?invite_code=gev New user? Trade now to get up to $ Welcome Bonus. Earn up to $ welcome bonus! Register on Huobi now, No. 1 Crypto. Huobi Global Referral Code/Invite Code - Get $ bonus + 15% OFF trading fee. Use the referral code ywpj or use this signup link to get. Click on the sign up option to complete the process. After this, a new account would be created for the user and their welcome bonus would be deposited. However.

Zero Interest Balance Transfer

0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - % based on your creditworthiness. For instance, it offers an month 0% APR, which gives you an extended term to pay down transferred balances. The card also comes with no annual fee and. Our lowest intro APR on balance transfers and purchases Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard. Low Rate Credit Card Benefits · New Cardholders: 0% for 12 months introductory APR on purchases within the first year and balance transfers completed within the. Some credit cards offer a low-interest rate, or zero interest, for an introductory period. These special rates may only last for a few months. After that, the. Save on interest 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Balance transfers give you the chance to move high-interest credit card balances from one card over to a different card with a low or zero percent introductory. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - % based on your creditworthiness. For instance, it offers an month 0% APR, which gives you an extended term to pay down transferred balances. The card also comes with no annual fee and. Our lowest intro APR on balance transfers and purchases Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard. Low Rate Credit Card Benefits · New Cardholders: 0% for 12 months introductory APR on purchases within the first year and balance transfers completed within the. Some credit cards offer a low-interest rate, or zero interest, for an introductory period. These special rates may only last for a few months. After that, the. Save on interest 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Balance transfers give you the chance to move high-interest credit card balances from one card over to a different card with a low or zero percent introductory. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and.

By completing a balance transfer, you'll end up paying less interest each month or no interest at all, depending on if your card comes with an introductory 0%. If you have a 0% introductory or promotional APR balance transfer and also use your Account to make Purchases, you can avoid paying interest if you pay the “. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. Plus, you can transfer balances to the Classic Card as many times as you'd like at our promotional rate and with no PSECU balance transfer fee (up to your. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. Save money when you switch to one of our low-interest credit cards. All three options include a low rate and no or low transfer fees. PROMO RATE. The 0% rate is usually valid for 12 or 18 months, sometimes more. Can you pay off the transferred balance during that period? If not, what interest rate kicks. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. To avoid paying interest on purchases, you must pay your entire outstanding balance, including the amount of any balance transfer and balance transfer fee, by. Now through September 30, enjoy balance transfer rates as low as 0% APR* for 12 months when you move your existing balances to a select Apple FCU Visa® Credit. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. The debt lasso method is a popular strategy for using balance transfers to pay off debt faster. It involves “lassoing” as many credit cards as you can to the. Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. Easily transfer high-interest balances from other credit cards to one of our low-rate options and start saving with no balance transfer fees. Pay Off Credit. By utilizing an intro 0% APR offer, you can save money on interest and put all of your payments toward the principal balance. Take note that most balance. These cards may offer a low introductory APR—often 0 percent—for a set time period. During this introductory period, you may pay low or no interest at all. Consolidate and transfer your credit card balance for free with Skyla. Enjoy 0% APR (don't forget about that super helpful, interest-saving 0% APR1 on. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. It's easy and there are no fees to transfer a balance. Reasons to transfer a balance. Lower your interest rate; Consolidate debt from higher-rate loans and/or.

Bill Williams Trader

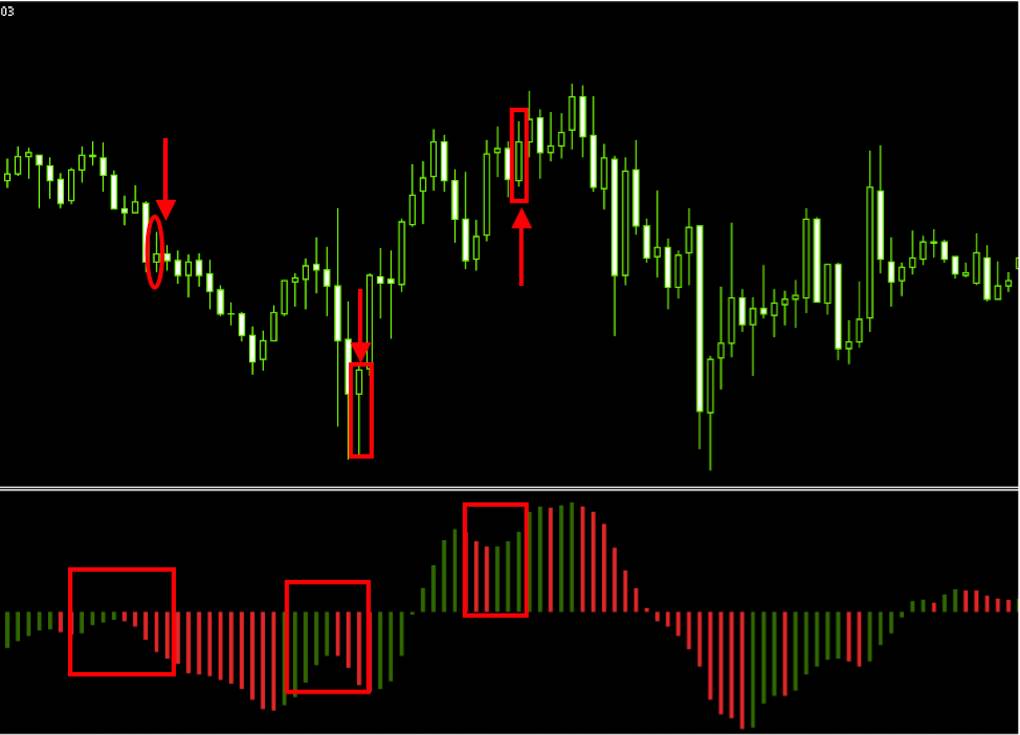

I talk a lot about what all brand new raw beginner investors and traders must learn on my Beginner Trading with J.R. Calcaterra Podcast. Bill Williams refers to these moving averages as “balance lines”. You can The Alligator will chase the price far away and offer a decent profit to a trader. Bill Williams Trader Story. Bill Williams, the trader, was born in and is widely known as a visionary and forefather for modern day trading psychology. It's time to trade! The Alligator will chase the price far away and offer a decent profit to a trader. Having eaten enough, the Alligator goes back to sleep . American trader and author of books on trading psychology. Bill Williams invented many indicators and gave them unique and catchy names, such as Awesome. Bill Williams is a recognized trader, writer and psychologist from the USA, who has won credit for his contributions to trading and financial analysis. BILL WILLIAMS, PhD, is a full-time commodity trader. He is president of Profitunity Trading Group which holds workshops and training sessions on commodity. Share ideas, debate tactics, and swap war stories with forex traders from around the world. His daughter, Justine Williams-Lara (JWL), is the president of the Profitunity Trading Group. She has been actively trading for 14 years in both the stock and. I talk a lot about what all brand new raw beginner investors and traders must learn on my Beginner Trading with J.R. Calcaterra Podcast. Bill Williams refers to these moving averages as “balance lines”. You can The Alligator will chase the price far away and offer a decent profit to a trader. Bill Williams Trader Story. Bill Williams, the trader, was born in and is widely known as a visionary and forefather for modern day trading psychology. It's time to trade! The Alligator will chase the price far away and offer a decent profit to a trader. Having eaten enough, the Alligator goes back to sleep . American trader and author of books on trading psychology. Bill Williams invented many indicators and gave them unique and catchy names, such as Awesome. Bill Williams is a recognized trader, writer and psychologist from the USA, who has won credit for his contributions to trading and financial analysis. BILL WILLIAMS, PhD, is a full-time commodity trader. He is president of Profitunity Trading Group which holds workshops and training sessions on commodity. Share ideas, debate tactics, and swap war stories with forex traders from around the world. His daughter, Justine Williams-Lara (JWL), is the president of the Profitunity Trading Group. She has been actively trading for 14 years in both the stock and.

The Williams Alligator Indicator is a technical trading tool created by legendary trader Bill Williams. It is based on the relationship between three separa. He saw the market as having 5 dimensions that help traders understand the market's structure, and he developed several popular indicators. (Fractals, the. Bill Williams, the trader who developed the alligator indicator, believed that markets only follow a trend 15% to 30% of the time. Let's explore the. Fractals by Bill Williams. Modified with the help of Mrlogik. This is one of the five indicators that are part of Bill Williams' Profitunity System. Bill M Williams is a well-known trader, author and educator with over 50 years of trading experience in several markets. — Indicators and Signals. I've made a lot of trades. I've also made a lot of traders. I'd like to share nearly 60 years of trading experience with you. If you. Bill Williams. The strategy itself is well known and its use is still controversial among traders. The article considers trading signals of the system, the. Fractal Breakout Strategy. Fractals look as follows on the chart of MetaTrader 4 terminal: how to use fractals in trading. Each arrow on the chart marks a. Profitunity (Chaos) Trading System by Bill Williams Hello traders, I recently found out chaos system and read the books about it (by Bill Williams). I was. Adding the Bill Williams Accelerator Oscillator to your MetaTrader 4 charts is a breeze. Here is how to do it: Navigate in the top menu to Insert. Bill Williams Indicators were designed by legendary trader Bill Williams as he developed his trading strategy. ➔ Learn how to use the indicators for. The Bill Williams Awesome oscillator is an indicator that traders use to measure momentum in a market with the aim of detecting potential trend direction or. In Bill and Ellen Williams moved to a small town in Georgia. Bill had always been involved in the markets but at this time he decided to be dedicated. Fractals By Bill Williams. This is a conversion of the NT7 indicator Fractals by Bill Williams. Please contact the original author for any questions or comments. Thus, Bill Williams developed an independent trading system and started to teach traders to use it for investment business. The “Trading Chaos” is still popular. At this point, the trader would either hold onto the trades and wait for the market trend to become stronger or trade against the current trend with an. Bill Williams introduced the Alligator which is a system that uses three trades. All trademarks belong to their respective owners. We are not. Bill Williams' theory has become very popular among Forex (link to ) traders. Bill William's Chaos Theory. Alligator and Gator. Bill Williams describes the. Bill Williams thought that the reason of losing in the market lies in traders' reliance on different types of analyses and on the rules based on them. B. Alligator and Fractals of Bill Williams There are a lot of signals in the trading strategy of Bill Williams which help a trader to open successful orders, but.

What Banks Have High Yield Savings Accounts

:max_bytes(150000):strip_icc()/bestbanksforsavingsaccounts-d120e1006996432ebf4f2902d4e58d72.jpg)

UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · % ; SoFi Checking and Savings · % ; CIT Bank. Access our Premier Savings account. With tiered interest, you'll get better rates the more you save. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Wealthfront. 5% APY. No direct deposit requirement like SoFi. Can create categories for different goals. If you have an individual account I believe you can. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. Here's what you should know. Kiss bank fees goodbye. The Chime Savings Account has no monthly fees,2 no maximums on interest earned, and no minimum balance requirement. U.S. Bank Smartly® Savings is our new relationship savings account with competitive rates that grow as your balances grow. Unlock higher rates and better. A high-yield savings account offers a higher rate of return than a traditional savings account. Learn about the benefits of this type of bank account and. Best High-Yield Savings Accounts for September Up to % · Poppy Bank · Flagstar Bank · Western Alliance Bank · Forbright Bank · Vio Bank · BrioDirect · Ivy. UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · % ; SoFi Checking and Savings · % ; CIT Bank. Access our Premier Savings account. With tiered interest, you'll get better rates the more you save. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Wealthfront. 5% APY. No direct deposit requirement like SoFi. Can create categories for different goals. If you have an individual account I believe you can. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. Here's what you should know. Kiss bank fees goodbye. The Chime Savings Account has no monthly fees,2 no maximums on interest earned, and no minimum balance requirement. U.S. Bank Smartly® Savings is our new relationship savings account with competitive rates that grow as your balances grow. Unlock higher rates and better. A high-yield savings account offers a higher rate of return than a traditional savings account. Learn about the benefits of this type of bank account and. Best High-Yield Savings Accounts for September Up to % · Poppy Bank · Flagstar Bank · Western Alliance Bank · Forbright Bank · Vio Bank · BrioDirect · Ivy.

A good option if · Interest rates · Automatic transfers · Free Overdraft Protection if linked to a Fifth Third Momentum® Checking Account · Skip the monthly. What is a high yield savings account? · Competitive interest rate on online savings accounts · More features of our High-Yield Savings Account · Cookie Notice. High-Rate Savings Account Features · Bank on your terms with Alliant's high interest online savings account · A credit union savings account that does things. Step into the future with our evolved high-yield bank account that charges no monthly maintenance fees and has no minimum deposit requirement to open. Our picks at a glance · My Banking Direct High Yield Savings · Varo Savings Account · UFB Direct High Yield Savings · EverBank Performance Savings · Laurel Road High. Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %. Additionally, you can call our U.S.-based Banking Specialists 24/7 at to open an account over the phone. What is the minimum. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Complete with no fees and our highest interest rates, our high yield savings account may be the perfect way to sit back and put your savings to work. For example, Bank of America, Chase Bank, and Wells Fargo offer a measly APY of % on their savings accounts, whereas most of the options listed above are. Looking for other options that earn interest? We've got them. Money Market Accounts (MMAs). %. APY*. No. Just maintain a balance of $10, or more to earn interest. It's easy to open an account: Current Members - Open in Online Banking | New to Citadel? Open An. A high-yield savings account (HYSA) is a type of savings account that pays a higher than average interest rate on deposits. With Western Alliance Bank, your. Otherwise, accounts will earn the Standard Rate of % APY. Interest payments, account bonuses, account credits and reversals or refunds from the bank are not. Maximize your savings with an American Express high yield savings account with Member FDIC & competitive interest rates offered in market. Open an account. A tiered-rate monthly statement savings account that pays a competitive interest rate on higher balances. A minimum balance must be maintained in order to. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. SoFi members with direct deposit are eligible for other SoFi Plus. Our High-Yield Online Savings Account is the smart choice for anyone looking to grow their savings and achieve financial stability. Start your journey to. Ally Bank Savings Account balance tiers: · Less than $5, · Between $5, and $24, · $25, or more. The APY we pay is based on the.