dinas-vl.ru News

News

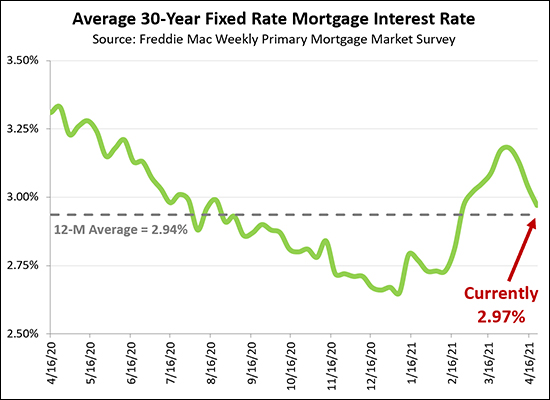

Mortgage Interest Rates Update

Mortgage Rate Predictions for 20· loanDepot: Mortgage rates could fall below 6% in Q4 · BrightMLS: Year, fixed rate to hover below % in Q4. year fixed-rate mortgage: %. Average year fixed mortgage rates nearly reached 8% in the second half of , but finally fell below 7% in mid-. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. You get a% interest rate relationship discount when you Bank with Key or when you sign up for automatic payments from a KeyBank checking account. Mortgage rates fall to lowest since April Here's where they're headed. · Aug 28 ; Here are the top zip codes for home sales, according to dinas-vl.ru · Aug. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Mortgage rates stabilized this week, averaging % for year fixed loans, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 10 pm EST. Daily Rate Survey ; 15 Yr. Fixed, %, % ; 30 Yr. Jumbo, %, +% ; 7/6 SOFR ARM, %, % ; 30 Yr. FHA, %, +%. Mortgage Rate Predictions for 20· loanDepot: Mortgage rates could fall below 6% in Q4 · BrightMLS: Year, fixed rate to hover below % in Q4. year fixed-rate mortgage: %. Average year fixed mortgage rates nearly reached 8% in the second half of , but finally fell below 7% in mid-. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. You get a% interest rate relationship discount when you Bank with Key or when you sign up for automatic payments from a KeyBank checking account. Mortgage rates fall to lowest since April Here's where they're headed. · Aug 28 ; Here are the top zip codes for home sales, according to dinas-vl.ru · Aug. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Mortgage rates stabilized this week, averaging % for year fixed loans, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 10 pm EST. Daily Rate Survey ; 15 Yr. Fixed, %, % ; 30 Yr. Jumbo, %, +% ; 7/6 SOFR ARM, %, % ; 30 Yr. FHA, %, +%.

Get personalized mortgage advice. We'll help you find a mortgage rate and term to match your goals. The current Bank of Canada overnight rate is %. The bank cut 25 basis points thrice this year, bringing the rate down from its historical high of 5%. The. Check out today's mortgage rates and trends. ** 3-year fixed-to-adjustable rate: Initial % (% APR) is fixed for 3 years, then adjusts annually based on an index and margin. For a year loan of. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. Depending on the kind of mortgage you have, a rise in the fed funds rate could result in major changes in your monthly mortgage payment. New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · %. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until A VA loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included; therefore. Fixed year mortgage rates in the United States averaged percent in the week ending August 30 of Mortgage Rate in the United States is expected to. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. On Tuesday, Sept. 10, , the average interest rate on a year fixed-rate mortgage jumped seven basis points to % APR. The average rate on. Today's competitive mortgage rates ; year · % · % · · $1, ; year · % · % · · $1, ; year · % · % · · $1, View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Washington State mortgage rates ; Conforming year fixed, %, % ; Conforming year fixed, %, % ; Conforming 7/1 ARM, %, % ; Jumbo. Looking for Canadian mortgage rates? Explore TD Mortgages and our mortgage rates today to find the right mortgage interest rate for you. Knowing your options and what to expect helps ensure that you get a mortgage that is right for you. Check back often -- the rates in the tool are updated every.

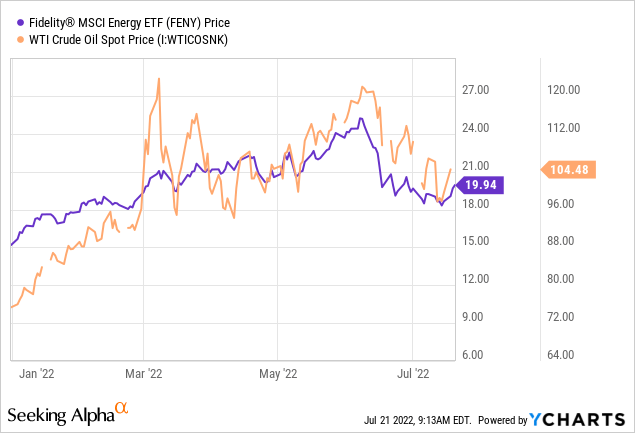

Msci Energy Index Etf

The MSCI Global Alternative Energy Index was launched on Jan 20, Data prior to the launch date is back-tested test (i.e. calculations of how the index. Fidelity MSCI Energy Index ETF. FENY tracks a market-cap-weighted index of US energy companies. The index includes those companies deemed investable by MSCI and. The Fund seeks to track the performance of an index composed of developed market equities in the energy sector. The ETF seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy 25/50 Index. View the latest Fidelity MSCI Energy Index ETF (FENY) stock price and news, and other vital information for better exchange traded fund investing. All securities in the index are classified in the Energy as per the Global Industry Classification Standard (GICS®). For a complete description of the index. The Fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy Index. The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy 25/ The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy 25/ The MSCI Global Alternative Energy Index was launched on Jan 20, Data prior to the launch date is back-tested test (i.e. calculations of how the index. Fidelity MSCI Energy Index ETF. FENY tracks a market-cap-weighted index of US energy companies. The index includes those companies deemed investable by MSCI and. The Fund seeks to track the performance of an index composed of developed market equities in the energy sector. The ETF seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy 25/50 Index. View the latest Fidelity MSCI Energy Index ETF (FENY) stock price and news, and other vital information for better exchange traded fund investing. All securities in the index are classified in the Energy as per the Global Industry Classification Standard (GICS®). For a complete description of the index. The Fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy Index. The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy 25/ The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy 25/

See all ETFs tracking the MSCI World Energy Index, including the cheapest and the most popular among them. Compare their price, performance, expenses, a. Learn everything about Fidelity MSCI Energy Index ETF (FENY). News, analyses, holdings, benchmarks, and quotes. Get comprehensive information about Fidelity MSCI Energy Index ETF (USD) (US) - quotes, charts, historical data, and more for informed investment. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Fidelity MSCI Energy Index ETF (FENY). Gain valuable insights from earnings. The fund's underlying index is the MSCI USA IMI Energy 25/50 Index, which represents the performance of the energy sector in the U.S. equity market. It may or. Fidelity MSCI Energy Index ETF · AM, Upgrade to FINVIZ*Elite to get real-time quotes, intraday charts, and advanced charting tools. · AM, Upgrade to. Fidelity MSCI Energy Index ETF (FENY) Find here information about the Fidelity MSCI Energy Index ETF (FENY). Assess the FENY stock price quote today as well. Broad market access with Xtrackers ETFs ✓ Latest ETF information ✓ Costs & fees ✓ Index information ➔ Invest in IE00BM67HM91 now! The Fidelity MSCI Energy Index ETF seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA. Investing at least 80% of assets in securities included in the fund's underlying index. The fund's underlying index is the MSCI USA IMI Energy 25/50 Index. The index is an unmanaged index composed of more than 1, stocks listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. The MSCI Global Alternative Energy Index was launched on Jan 20, Data prior to the launch date is back-tested test (i.e. calculations of how the index. View Top Holdings and Key Holding Information for Fidelity MSCI Energy Index ETF (FENY). ETF strategy - FIDELITY MSCI ENERGY INDEX ETF - Current price data, news, charts and performance. Find the latest quotes for Fidelity MSCI Energy Index ETF (FENY) as well as ETF details, charts and news at dinas-vl.ru Objective. The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy. Get the latest Fidelity MSCI Energy Index ETF (FENY) real-time quote, historical performance, charts, and other financial information to help you make more. Explore Fidelity MSCI Energy Index ETF ETF (Exchange-Traded Funds) quotes online or analyze past movements of FENY. The chart is updated automatically and. All securities in the index are classified in the Energy sector as per the Global Industry Classification Standard (GICS®). For a complete description of the. Fidelity MSCI Energy Index ETF FENY has $ BILLION invested in fossil fuels, 99% of the fund.

Refinancing A Car With Low Credit Score

Refinancing your loan essentially replaces your existing car loan with a new one that can help you save money with a lower interest rate and lower monthly. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining. There's no universal minimum credit score for car loans, but a score of or higher can mean you're offered better loan terms. Learn how your. With the requirements we mentioned before satisfied, and your documents gathered, you can apply to refinance online or over the phone through our lending. How to Refinance a Car Loan With Bad Credit · Check your credit report · Add a cosigner · Think about trading in · Connect with a lender that knows how to help · You. You can refinance your auto loan anytime. The sooner you refinance, the more money you'll save. That being said, if you need to work on your credit, it makes. It's still possible to qualify for car loan refinancing if your credit score is significantly below Since there are other factors used to determine whether. An auto loan refinance can be a smart move in the right situations. By receiving a lower rate, you could cut your interest costs, reduce your monthly payment. A minimum credit score of is required to refinance your auto loan with Capital One. Those aren't the only requirements for approval — any vehicle up for. Refinancing your loan essentially replaces your existing car loan with a new one that can help you save money with a lower interest rate and lower monthly. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining. There's no universal minimum credit score for car loans, but a score of or higher can mean you're offered better loan terms. Learn how your. With the requirements we mentioned before satisfied, and your documents gathered, you can apply to refinance online or over the phone through our lending. How to Refinance a Car Loan With Bad Credit · Check your credit report · Add a cosigner · Think about trading in · Connect with a lender that knows how to help · You. You can refinance your auto loan anytime. The sooner you refinance, the more money you'll save. That being said, if you need to work on your credit, it makes. It's still possible to qualify for car loan refinancing if your credit score is significantly below Since there are other factors used to determine whether. An auto loan refinance can be a smart move in the right situations. By receiving a lower rate, you could cut your interest costs, reduce your monthly payment. A minimum credit score of is required to refinance your auto loan with Capital One. Those aren't the only requirements for approval — any vehicle up for.

If you applied for a car loan with a low credit score, the interest rates you signed off on were probably less than ideal. Never fear, though – if you've. Refinancing a car involves taking out a new auto loan and using it to pay off your existing loan. You might refinance your car to obtain a better interest rate. The approval process for a refinance can take as little as a few minutes. After your new loan is signed, you can have up to 60 days with no payments before. If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. Getting an auto refinance is still possible with a bad or low credit score, but you may not be offered the best interest rates. Knowing what lenders are. If you're dealing with a history of bad credit, the best recommendation is to wait at least a year before refinancing your car loan. When financing a car with bad credit, a down payment, trading in your current vehicle, or both, can be particularly helpful. Each may lower the principal loan. The approval process for a refinance can take as little as a few minutes. After your new loan is signed, you can have up to 60 days with no payments before. When will a lender refuse to refinance a car loan? · Your car: Should be under 10 years old and have less than , miles on it · Your current loan: Should. Refinance your car loan online in 3 easy steps ; Check your rate. Check your rate in minutes – without affecting your credit score.¹. Upstart Auto Refi Funding. Auto refinance rates from the lenders on this page start as low as % depending on the lender and your credit. But it's hard to tell what rates you'll get. A minimum credit score of is required to refinance your auto loan with Capital One. Those aren't the only requirements for approval — any vehicle up for. With the requirements we mentioned before satisfied, and your documents gathered, you can apply to refinance online or over the phone through our lending. Refinancing a car loan means replacing your current car finance agreement with different (most likely, better) terms. The new loan, often with a new lender. Refinancing your car means replacing your current auto loan with a new one. The new loan pays off your original loan, and you begin making monthly payments on. Why Refinance a Loan · Lower Monthly Car Payments: Secure a lower interest rate to reduce your monthly expenses on your vehicle. · Save Money: Paying less. What is the lowest credit score you can have to refinance a car? When it comes to auto refinancing, there is no lowest or minimum credit score required. For Auto Refinancing Loans, APR ranges from % to %. APRs are determined at the time of application. Lowest APR is available to borrowers with excellent. Sometime between 6 months and 2 years may be an ideal time to refinance. It gives an opportunity for a credit score to improve and to make some inroads on the. Another common reason for refinancing is to simply lower your monthly payments and take some stress off your budget. You might do this by extending your loan.

Why Do I Forget To Eat

Food and eating for people with Alzheimer's or other dementias – get tips on planning meals, encouraging indepence and minimizing nutrition problems. A lot of people with ADHD struggle with disordered eating, too. And not enough of us are talking about it. People forget to eat for varying reasons. You could just be really busy and forget a meal here and there. This can be normal - if it persists. ADHD is the most commonly missed diagnosis in relation to food and appetite problems. Learn more about ADHD and eating disorders here. Are you looking for an eating disorder treatment provider in your area or online? Find treatment here. Are you looking for nutrition counseling that is covered. How can you forget to eat when this is basic need of you to survive you may skip 1 meal or 2 meal but you cannot forget to eat unless like. A person with dementia may lose interest in food. They may refuse to eat it or may spit it out. The person may become angry or agitated, or behave in a. Learn how to recognize the symptoms of anorexia, bulimia, binge eating disorder, pica, rumination disorder, and avoidant/restrictive food intake disorder. The Forgets to Eat trope as used in popular culture. This trope describes a character who's notorious for ignoring their body's need for nutrition and has. Food and eating for people with Alzheimer's or other dementias – get tips on planning meals, encouraging indepence and minimizing nutrition problems. A lot of people with ADHD struggle with disordered eating, too. And not enough of us are talking about it. People forget to eat for varying reasons. You could just be really busy and forget a meal here and there. This can be normal - if it persists. ADHD is the most commonly missed diagnosis in relation to food and appetite problems. Learn more about ADHD and eating disorders here. Are you looking for an eating disorder treatment provider in your area or online? Find treatment here. Are you looking for nutrition counseling that is covered. How can you forget to eat when this is basic need of you to survive you may skip 1 meal or 2 meal but you cannot forget to eat unless like. A person with dementia may lose interest in food. They may refuse to eat it or may spit it out. The person may become angry or agitated, or behave in a. Learn how to recognize the symptoms of anorexia, bulimia, binge eating disorder, pica, rumination disorder, and avoidant/restrictive food intake disorder. The Forgets to Eat trope as used in popular culture. This trope describes a character who's notorious for ignoring their body's need for nutrition and has.

A person with dementia may find eating difficult. Loss of appetite, loss of memory and problems with judgement can cause difficulties with food, eating and. High quality example sentences with “do not forget to eat” in context from reliable sources - Ludwig is the linguistic search engine that helps you to write. That's a really good way to dive head-first into a binge. So, I meticulously plan the food I eat — breakfast, morning snack, lunch, afternoon. A person living with dementia may stop eating or drinking. Explore long someone can live without eating and drinking and how to offer the best end-of-life. If you regularly forget to eat, it might be time to start exercising, walking or simply moving more. Why? Because it can help you to tap into your appetite. Many times during the workweek I do forget to eat lunch due to being busy, involved, or pulled in eight directions. Usually a vague headache or. Eating more or less than usual, and gaining or losing weight suddenly may be a sign you need to see a doctor. Learn more on why your appetite changes. Learn how to recognize the symptoms of anorexia, bulimia, binge eating disorder, pica, rumination disorder, and avoidant/restrictive food intake disorder. Specifically the coding and testing part of game development. Writing line after line of code for a light paycheck isn't the worst thing I could be doing. No. Some diet changes may help you avoid feeling hungry after eating. Try to eat more foods that are high in protein, fiber, and healthy fats. And eat fewer refined. Emotional eating is when people use food as a way to deal with feelings instead of to satisfy hunger. A person with dementia may struggle to recognise the food and drink in front of them. They may also be unsure how to begin eating. These problems may start. A person with dementia may find eating difficult. Loss of appetite, loss of memory and problems with judgement can cause difficulties with food, eating and. If you're struggling with depression and loss of appetite, we have looked at why this can happen and what you can do in order to start feeling better. Emotions are running high these days, and that can lead to all sorts of negative habits, especially around food. Are you eating more than. ADHD is the most commonly missed diagnosis in relation to food and appetite problems. Learn more about ADHD and eating disorders here. Doesn't make much sense. Well, you're right, but there's eating, and then there's Eating. With a capital. To suggest the second one is better. Recognise your hunger. Feeling hungry - Awaiting food. Eat when your body tells you that you're hungry and stop eating when you are full. 3. By Julie Garden-Robinson, Food and Nutrition Specialist. NDSU Extension. “When was the last time you had something to eat?” I ask my family, especially when. Put a stop to emotional and stress eating by identifying triggers, fighting cravings, and finding more satisfying ways to feed your feelings.

Ira 401k 403b

A (b) plan is a retirement account that can be offered only by public school systems, nonprofit organizations, and some churches and hospitals. Rollover IRAs: A way to combine old (k)s and other retirement accounts · Leave your money in your former employer's plan, if your former employer permits it. What does a (k) or (b) plan offer? · Automatic payroll deductions to help you make saving a habit · Reduced taxable income, through pre-tax contributions. The George Washington University Supplemental Retirement Plan ((b) Plan) allows you to make Pre-Tax or Post-Tax Roth contributions. A (b) is a retirement plan set up by your employer that allows you to set aside money for retirement on a pre-tax basis through salary reduction. Your. The (b) Plan and (b) Plan are supplemental retirement plans that allow you to save up to the IRS limits for additional savings. While (k) plans are primarily offered to employees in for-profit companies, (b) plans are offered to not-for-profit organizations and government employees. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. A (b) plan is an employer-sponsored retirement plan that's very similar to a (k) plan. The key difference is that (b) plans are offered by public. A (b) plan is a retirement account that can be offered only by public school systems, nonprofit organizations, and some churches and hospitals. Rollover IRAs: A way to combine old (k)s and other retirement accounts · Leave your money in your former employer's plan, if your former employer permits it. What does a (k) or (b) plan offer? · Automatic payroll deductions to help you make saving a habit · Reduced taxable income, through pre-tax contributions. The George Washington University Supplemental Retirement Plan ((b) Plan) allows you to make Pre-Tax or Post-Tax Roth contributions. A (b) is a retirement plan set up by your employer that allows you to set aside money for retirement on a pre-tax basis through salary reduction. Your. The (b) Plan and (b) Plan are supplemental retirement plans that allow you to save up to the IRS limits for additional savings. While (k) plans are primarily offered to employees in for-profit companies, (b) plans are offered to not-for-profit organizations and government employees. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. A (b) plan is an employer-sponsored retirement plan that's very similar to a (k) plan. The key difference is that (b) plans are offered by public.

An IRA has more, and often better, investment choices than a (b) and IRA fees tend to be lower, sometimes significantly so. An IRA has more, and often better, investment choices than a (b) and IRA fees tend to be lower, sometimes significantly so. The (b) retirement plan can help you save a lot for when you stop working. But the IRS limits the amount you can contribute each year. Get your estimated balance with J.P. Morgan Wealth Management's (k)/(b) retirement calculator. Learn more about how your balance is calculated. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). Like a Roth IRA, a Roth (b) and Roth (k) offer tax-free withdrawals if the account is at least five years old and you are at least age 59½. Early. Retirement Plans · Retirement Annuities · IRAs · Personal Annuities · Target Date Funds · We're here to help · Find a local office · Connect with us. If your employer offers a retirement plan, like a (k) or (b), and will match a percentage of your contributions, you should definitely take advantage. A (b) plan is tax-deferred retirement savings plan offered to public school employees through their school districts or open-enrollment charter schools. Participation in the (b) Plan is voluntary, and does not reduce any of your other University benefits based on salary – such as SURS retirement, long-term. Traditional (k), (b), and IRA contributions leave money in your pocket because they generally lower your current taxable income. But these tax savings can. A (b) is a type of retirement plan available for employees in public schools, charitable (c)(3) tax-exempt organizations, and certain faith-based. You can elect to roll your funds into a different account, such as an IRA or (k). The (b) rollover rules differ based on the type of account you choose. The most common types of retirement plans offered by employers are (k)s and (b)s. Saving in these types of plans can be important but investing your money. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. Roll over your old (k) or (b) to a Vanguard IRA to gain investment flexibility without losing tax benefits. Give your money a fresh start today! The Faculty and Staff Retirement Plan allows you to contribute on a Roth after tax basis. Through the Roth (b) option you can make contributions that are. A Roth (b) is a retirement savings account similar to a traditional (b), but it uses after-tax contributions, so withdrawals are tax-free. A (b) is like a (k), but it is only for nonprofits and governmental employees. As an employee, a (b) works much the same as a (k). Stay informed: IRS limits ; Contribution limits for (k) plans · Employee pre-tax and Roth contributions · $22, ; Contribution limits for (b) plans.

What Do I Need To Make A Wells Fargo Account

ATM/debit or credit card number or Wells Fargo account or loan number · Social Security or Tax ID number · Access to your email · Your current telephone number. 99% of what I do is through my main bank. If I need a branch service, I use one of the accounts I have open. For example, I needed to. $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 - 24 years old · A linked Wells Fargo Campus. What do I need to do to open a bank account at Wells Fargo? You can open a Wells Fargo online checking account here. You'll need your Social Security Number, a valid ID and a $25 opening deposit that you can easily. © Wells Fargo Bank, N.A. All rights reserved. Member FDIC. CNS IHA — If your current address does not match your government-issued ID. What you'll need to open a business deposit account · Information about your business. · Information about the owners of your business. · If applicable, entities. You'll need to make a minimum opening deposit of $25 to open a checking account with Wells Fargo. Does Wells Fargo offer a welcome bonus for opening a new. Two forms of identification (ID) are needed to open at a branch · Employee ID · Student ID · Credit card · ID issued by a recognized business or government agency. ATM/debit or credit card number or Wells Fargo account or loan number · Social Security or Tax ID number · Access to your email · Your current telephone number. 99% of what I do is through my main bank. If I need a branch service, I use one of the accounts I have open. For example, I needed to. $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 - 24 years old · A linked Wells Fargo Campus. What do I need to do to open a bank account at Wells Fargo? You can open a Wells Fargo online checking account here. You'll need your Social Security Number, a valid ID and a $25 opening deposit that you can easily. © Wells Fargo Bank, N.A. All rights reserved. Member FDIC. CNS IHA — If your current address does not match your government-issued ID. What you'll need to open a business deposit account · Information about your business. · Information about the owners of your business. · If applicable, entities. You'll need to make a minimum opening deposit of $25 to open a checking account with Wells Fargo. Does Wells Fargo offer a welcome bonus for opening a new. Two forms of identification (ID) are needed to open at a branch · Employee ID · Student ID · Credit card · ID issued by a recognized business or government agency.

All we need is a PAN card, an Aadhar card, and a valid email address. Once we have these documents ready, we can start the process by filling. Mobile and online banking when you need them. Manage your money on the Wells Fargo Mobile ® app when you're on the go. And use Wells Fargo Online. Simply select a link below to sign on and go directly to service you need. Make a Transfer · Order Checks · Order Official Bank Checks · Pay Bills · Replace. $10, in combined minimum daily balance; $1, or more in qualifying electronic deposit; Linked Home Mortgage account. New account. Everyday Checking. $ Compare our savings account rates to find the best savings account or CD account to reach your future savings goals. Build savings automatically — You can watch your savings grow by directing at least part of your pay to a savings account. * Some examples would include: Income. You want to do this because this will effectively allow you to put all your money your SoFi Savings account so that all your cash earns %. Minimum opening deposit is $ Provide later with required business documents when you apply online. Apply online below or make an appointment to apply in. Wells Fargo requires that you have this document notarized to protect your • If receiving funds by wire transfer, did you provide the required bank and. Do I need to link my WellsTrade account to my existing Wells Fargo Bank Prime Checking or Premier Checking account? Must be 13 or older · Teens 13 – 16 years old need an adult co-owner · 17 and under must open at a branch · IDs required to open. Need to open an account or apply for a loan? Explore convenient and secure ways to open checking, savings, and CD accounts, or apply for loans and credit. For teens age 13 - 16, look no further than the Clear Access Banking account. Great for middle and high school students and parents who want a joint account. You must be 18 or older to apply online. 17 and under must open at a branch. No matter how you apply, you'll need: Your Social Security number; Valid ID. Open a new checking account with a minimum $25 deposit. The offer page specifies that you'll need to open an Everyday Checking account for this offer. You can open a Premier Checking account with only $ But you'll need to have at least a total of $, in total balances in certain accounts at Wells Fargo. You can open most of our business accounts with a minimum opening deposit of $ What documentation is required to open a business account?Expand. Visit What. Open an Everyday Checking account with a minimum opening deposit of $25 from this offer webpage. Complete the qualifying requirements to receive your $ Find the best account for you · Clear Access Banking · Everyday Checking · Prime Checking · Premier Checking. do not already have a personal checking account with the bank. If you Wells Fargo requires your new account to remain open for the entire day.

Make Money Anonymously Online

Earn cash through Facebook Marketplace or turn game playing into a lucrative avenue. Online surveys and focus groups offer a chance to make extra cash. Even. Here's an interesting case study from a guy in the US. It seems he's something of a big name in his day job, so he wanted a way to make extra money online. In '51 Tips for Making Money Online' you will learn some important facts and gain some insights into how you can make an income from the internet, using just a. As of May 1, , Correct Pay is the money transfer service provider for FDC. Make a Payment Now – Payment Options. Online at dinas-vl.ru Send. While it is possible to make money anonymously on the platform, it requires more effort and may not generate as much income as those who promote themselves and. Silent Donor's donation average is over 3x the US online national giving average – anonymous All donations are sent through our private funds, which. Explore topics such as online business, passive income, and various money-making methods. Investing Niche: Channels like “Chris Invest” focus on. We will discuss freelancing, affiliate marketing, creating and selling digital products, online consulting and coaching, and virtual assistance. The short answer is, YES, you can make money and earn an income with an anonymous blog! Finsavvy Panda blog was earning a healthy income by blogging anonymously. Earn cash through Facebook Marketplace or turn game playing into a lucrative avenue. Online surveys and focus groups offer a chance to make extra cash. Even. Here's an interesting case study from a guy in the US. It seems he's something of a big name in his day job, so he wanted a way to make extra money online. In '51 Tips for Making Money Online' you will learn some important facts and gain some insights into how you can make an income from the internet, using just a. As of May 1, , Correct Pay is the money transfer service provider for FDC. Make a Payment Now – Payment Options. Online at dinas-vl.ru Send. While it is possible to make money anonymously on the platform, it requires more effort and may not generate as much income as those who promote themselves and. Silent Donor's donation average is over 3x the US online national giving average – anonymous All donations are sent through our private funds, which. Explore topics such as online business, passive income, and various money-making methods. Investing Niche: Channels like “Chris Invest” focus on. We will discuss freelancing, affiliate marketing, creating and selling digital products, online consulting and coaching, and virtual assistance. The short answer is, YES, you can make money and earn an income with an anonymous blog! Finsavvy Panda blog was earning a healthy income by blogging anonymously.

How To Remain Anonymous on the Internet · Use a VPN. “VPN” stands for “virtual private network,” and, unlike Tor, VPNs encrypt all web traffic from browsers and. How to create an online course · Tips for how to make money selling online courses. 1. Choose the right online course platform. 2. Create a free mini-course. 3. 1. Create an alter-ego email address on Paypal. · 2. Use money transfer services. · 3. Have a third party deliver cash. · 4. Contribute to a Gofundme anonymously. With PayPal's money transfer services, you can safely send or transfer money, make online payments and pay online, in multiple currencies, to almost anyone. Keep in mind that there is no way to be completely anonymous online, and if you want to make money blogging, you have to get comfortable with that. Pros of. As mentioned, effectively managing an anonymous OnlyFans necessitates cultivating an attractive online persona, and your stage name plays a role. Prior to. Your data is valuable. You are in full control of which data you want to share—anonymously. The more you share, the more you can earn. Another excellent way to draw online traffic and gain new viewership to your anonymous blog is to create social media profiles under your pseudonym. Use the. Make Money with Internet Adult Web Sites, Ethically and Anonymously. online financial payment systems, ecommerce. F or the most part however, most of. M posts. Discover videos related to How to Make Money Anonymously TikTok video from Make Money Online (@makemoneyonli0): “Anonymous quote about Making. Why Would You Want to Make an Anonymous Payment? · Preparation · Option 1 - Using a Service Like dinas-vl.ru · Option 2 - Create a Business or Premier PayPal. Why Would You Want to Make an Anonymous Payment? · Preparation · Option 1 - Using a Service Like dinas-vl.ru · Option 2 - Create a Business or Premier PayPal. If you work in a certain sector, you can make money online anonymously from sponsored content by blogging without revealing your identity on Instagram. If. Can you be anonymous on OnlyFans? In today's digital era, maintaining anonymity online can be a tall order, especially for content creators. Other ideas for making money online: · Providing proofreading or editing services · Working as a freelance graphic designer · Offering personalized online shopping. If the payment is for an incarcerated person, the inmate should contact his/her counselor for information. When making a payment, please give the restitution. As of May 1, , Correct Pay is the money transfer service provider for FDC. Make a Payment Now – Payment Options. Online at dinas-vl.ru Send. Your data is valuable. You are in full control of which data you want to share—anonymously. The more you share, the more you can earn. In addition to the transfer fee, Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees. For one, you can make good money by blogging anonymously. It's possible to earn cash through affiliate marketing, advertisements, and other methods. Yet I.

Bank Account After Death

:max_bytes(150000):strip_icc()/payableondeath.asp_Final-666832193d1445b19aa1f3b2e9347ae3.png)

What is the timeline to contact KeyBank following an account holder's death? It is best to notify KeyBank as soon as possible. This will help to ensure any. The death of a loved one can cause a painful period of mourning and loss. However, the credit, financial, and online presence of a loved one continues even. We'll need a photocopy of the death certificate to verify the identity and legal residence of your loved one as well as confirm date of death. Most bank accounts that are held in the names of two people carry with them what's called the "right of survivorship." This means that after one co-owner dies. Then you'll need to either withdraw the assets to transfer them to new owners or change the name on the account to the new owners. When handling retirement. If the circumstances are such that a parent intends to have their adult child receive the joint bank account on death, by the right of. A payable on death (POD) designation means your bank account automatically transfers to a beneficiary upon the death of all account owners and co-owners. A bank will freeze a deceased customer's individual accounts when notified of the death. This includes transactional accounts, term deposits, credit cards and. The bank account will be completely closed (if it hasn't been already) and the money in the account will become part of your estate. What is the timeline to contact KeyBank following an account holder's death? It is best to notify KeyBank as soon as possible. This will help to ensure any. The death of a loved one can cause a painful period of mourning and loss. However, the credit, financial, and online presence of a loved one continues even. We'll need a photocopy of the death certificate to verify the identity and legal residence of your loved one as well as confirm date of death. Most bank accounts that are held in the names of two people carry with them what's called the "right of survivorship." This means that after one co-owner dies. Then you'll need to either withdraw the assets to transfer them to new owners or change the name on the account to the new owners. When handling retirement. If the circumstances are such that a parent intends to have their adult child receive the joint bank account on death, by the right of. A payable on death (POD) designation means your bank account automatically transfers to a beneficiary upon the death of all account owners and co-owners. A bank will freeze a deceased customer's individual accounts when notified of the death. This includes transactional accounts, term deposits, credit cards and. The bank account will be completely closed (if it hasn't been already) and the money in the account will become part of your estate.

Generally, the POA automatically expires upon the death of the account holder. State law and the terms of the POA would govern the status of the POA at that. Your beneficiaries will have immediate access to your bank accounts and investments after your death while avoiding the hassle and delays of probate court. (3) "Beneficiary" means a person named as one to whom sums on deposit in an account are payable on request after the death of all parties or for whom a party is. There are various components to the titling of assets: One is using a transfer on death (TOD) designation, generally used for investment accounts, or a payable. A bank will freeze the account when it receives notice that a customer has died while waiting for direction from the authorized court regarding payment to heirs. By written direction to the savings bank (or name of institution) I (or we), individually or jointly, may change the beneficiary or beneficiaries. 3. Upon my . The surviving joint account holders can provide the bank with a copy of the death certificate of the deceased and a copy of their NRICs. The bank will give the. Couples may also have joint bank or building society accounts. If one dies, all the money will go to the surviving partner without the need for probate or. What if the deceased's bank account is frozen? If you provide the bank with the Proof of Death from the funeral director and identification as executor. The bank account will then be transferred to the surviving joint owner. Bank accounts with a low balance. If the person who died had a bank account without much. How happens to my bank account after I die? Once a person has died, their bank accounts are typically cancelled by a next of kin, or executor of the will. Closing a bank account after someone dies · Executor/administrator will be required to contact the bank with proof of death – also note the executor/. Louisiana law allows limited access to a decedent's bank account and wages when these funds are needed to pay for final expenses. Are bank accounts frozen on death & how to probate the accounts. A bank will freeze acounts when they learn of the holder's death. Joint account holders and beneficiaries of payable-on-death accounts should contact the bank themselves to take ownership. When someone close to you passes. – Bank of America accounts. Contact Estate Servicing Operations to speak with our dedicated team. Monday through Friday, 9 a.m. – 8 p.m. Eastern. If the deceased has any loans or overdrafts with us, or a Barclaycard, we'll recover what they owe from their current account before releasing any remaining. Upon your death, the beneficiary (or beneficiaries) named on your account simply has to take a copy of your death certificate to the bank and provide proof. If a relative is a sole owner of a bank account, the account will likely be closed upon their death. The bank may require a certified death certificate in. Some banks or building societies will allow the executors or administrators to access the account of someone who has died without a Grant of Probate.

Seed Money For Business

How the Angel Investment Network Helps Raise Seed Capital / Seed Funding. Entrepreneurs that are looking to raise seed capital for their business idea can use. Seed funding is the very first official round of startup fundraising that most companies go through. As the name suggests, investors provide “seed money”. Learn the basics of seed funding and how you can find investors for your growing startup. The following sections provide expert knowledge and experience-based insights on funding, with a step-by-step guide on how to raise funds. Seed funding is used to take a startup from idea to the first steps, such as product development or market research. Seed funding (or seed financing, seeding. There are a few guidelines that founders should listen to carefully in order to raise seed capital and grow their startup. America's Seed Fund powered by the National Science Foundation (NSF SBIR/STTR) supports startups with research and development funding to create technologies. Seed money, also known as seed funding or seed capital, is a form of securities offering in which an investor puts capital in a startup company in exchange. The $ million Small Business Seed Funding Grant Program provides grant funding to early stage small and micro businesses and for-profit independent arts and. How the Angel Investment Network Helps Raise Seed Capital / Seed Funding. Entrepreneurs that are looking to raise seed capital for their business idea can use. Seed funding is the very first official round of startup fundraising that most companies go through. As the name suggests, investors provide “seed money”. Learn the basics of seed funding and how you can find investors for your growing startup. The following sections provide expert knowledge and experience-based insights on funding, with a step-by-step guide on how to raise funds. Seed funding is used to take a startup from idea to the first steps, such as product development or market research. Seed funding (or seed financing, seeding. There are a few guidelines that founders should listen to carefully in order to raise seed capital and grow their startup. America's Seed Fund powered by the National Science Foundation (NSF SBIR/STTR) supports startups with research and development funding to create technologies. Seed money, also known as seed funding or seed capital, is a form of securities offering in which an investor puts capital in a startup company in exchange. The $ million Small Business Seed Funding Grant Program provides grant funding to early stage small and micro businesses and for-profit independent arts and.

Seed funding is the first external round of investment. At this point, early stage startups must present investors with a developed business plan, market. This article serves as a complete guide to seed funding for startup founders and will explain when to start the seed round, how seed funding works and how much. Seed funding is typically a small amount of money invested in start-ups at the early stages of their business development. Startup Capital Resources · Venture capitalists · Incubators and accelerators · Angel investors · Small business loans · Equity-free financing. This brief guide is a summary of what startup founders need to know about raising the seed funds critical to getting their company off the ground. Seed money is the first round of capital for a new business. For many new enterprises, seed money provides the capital and funds needed to establish and grow. Seed funding is the initial investment made in a startup company to help it grow. Seed funding typically comes from friends, family, and angel investors. NIH's SEED Fund: Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Plus entrepreneurial and product. In order to calculate your seed funding requirements, you should model out how much money you will have to invest in your product, team, sales. Founders will consider future rounds of financing like raising “seed capital”or “seed fundraising”. This is especially true for high tech or larger companies. Fund your business yourself with self-funding. Otherwise known as bootstrapping, self-funding lets you leverage your own financial resources to support your. Start-ups can decide to raise the seed funding at various different stages. Investor community StartEngine recommends that companies aim to raise their seed. Seed money, also known as seed funding or seed capital, is a form of securities offering in which an investor puts capital in a startup company in exchange. NIH's SEED Fund: Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Plus entrepreneurial and product. Pre-seed funding is often the earliest stage of startup funding, coming before seed funding and other stages. During this stage, investors provide startups with. We funded about companies each year. Learn about our impact. We embrace diversity. Our program fosters and encourages participation in innovation and. Seed funding is an investment made by an individual to a business, aiding this business to grow further. It is an early investment made in a business to. Startups typically rely on various sources of seed funding to get their ventures off the ground. Here are some common sources of seed funding for startups. Seed funding is the initial funding that a business needs to establish itself in the market. It is possible for an entrepreneur to fund the business without the. Seed capital is the initial amount of money an entrepreneur uses to start a business. Often, this money comes from family, friends, early shareholders or angel.

Alphapoint

Join the ultimate low-poly FPS experience on Steam with AlphaPoint. Engage in intense multiplayer battles, experiment with unique weapons and characters. AlphaPoint specializes in white-label software solutions for cryptocurrency exchange operators in the financial technology sector. Use the CB Insights. Alphapointe provides employment opportunities and resources for people who are blind or visually impaired. AlphaPoint is a financial technology company powering the exchange of digital assets globally. Through its secure, scalable, and customizable digital asset. AlphaPoint and its award winning blockchain technology have helped over clients in 35 countries discover and execute their blockchain strategies since AlphaPoint is a white label software company powering crypto exchanges worldwide. Through our secure, scalable, and customizable digital asset trading platform. AlphaPoint Hooks. All Purpose Hooks. Bass Hooks. Big Game Hooks. Circle Hooks. Double Hooks. Treble Hooks. Heritage Fly Hooks. Fly Hooks. Jig Hooks. Alphapoint News · White Label Exchange Provider AlphaPoint Raises $ Million · Digital Asset Company AlphaPoint Upgrades Security Token Services for. AlphaPoint is a white-label software company powering crypto exchanges worldwide. Through our secure, scalable, and customizable digital asset trading. Join the ultimate low-poly FPS experience on Steam with AlphaPoint. Engage in intense multiplayer battles, experiment with unique weapons and characters. AlphaPoint specializes in white-label software solutions for cryptocurrency exchange operators in the financial technology sector. Use the CB Insights. Alphapointe provides employment opportunities and resources for people who are blind or visually impaired. AlphaPoint is a financial technology company powering the exchange of digital assets globally. Through its secure, scalable, and customizable digital asset. AlphaPoint and its award winning blockchain technology have helped over clients in 35 countries discover and execute their blockchain strategies since AlphaPoint is a white label software company powering crypto exchanges worldwide. Through our secure, scalable, and customizable digital asset trading platform. AlphaPoint Hooks. All Purpose Hooks. Bass Hooks. Big Game Hooks. Circle Hooks. Double Hooks. Treble Hooks. Heritage Fly Hooks. Fly Hooks. Jig Hooks. Alphapoint News · White Label Exchange Provider AlphaPoint Raises $ Million · Digital Asset Company AlphaPoint Upgrades Security Token Services for. AlphaPoint is a white-label software company powering crypto exchanges worldwide. Through our secure, scalable, and customizable digital asset trading.

AlphaPoint Exchange Platform Ratings · 87 Likeliness to Recommend · Plan to Renew · 83 Satisfaction of Cost Relative to Value. AlphaPoint's partnership with Microsoft is one of the secrets to their blockchain success. When AlphaPoint first started their business, they were using a small. Alphapointe, Kansas City, Missouri. likes · talking about this · were here. Non-profit dedicated to empowering people with vision loss to. AlphaPoint white label digital asset exchange technology designed for enterprise use by banks, brokers, asset managers, and payment companies. AlphaPoint is the only enterprise-grade software that enables institutions to both tokenize illiquid assets and trade those assets on an exchange. Alphapointe provides employment opportunities and resources for people who are blind or visually impaired. AlphaPoint is the leading exchange technology platform provider to support digital currencies. The company works with some of the top bitcoin and altcoin. dinas-vl.ru: NERF AlphaPoint Laser Ops Pro Toy Blasters - Includes 2 Blasters & 2 Armbands - Light & Sound FX - Health & Ammo Indicators - for Kids. Yoh Fintech quickly sourced and onboarded all very high-quality teams to design, architect, build, and deploy both platforms. Yoh's resources helped AlphaPoint. Accredited investors can buy pre-IPO stock in companies like AlphaPoint through EquityZen funds. These investments are made available by existing AlphaPoint. AlphaPoint Corporation is a white-label software company powering crypto exchanges and brokerages. The Company offers a white label digital asset trading. Blockchain services firm AlphaPoint has upgraded its tech solution for security token offerings in bid to attract institutional clients. AlphaPoint: Offers a secure and customizable digital asset trading platform that enabled over customers in 35 countries to launch and operate crypto. AlphaPoint Studios is a group on Roblox owned by AlphaPointHolder with members. "Introducing AlphapointStudio! This is a 2-man project, and we worked. AlphaPoint is a New York-based company that offers a range of products and services in the digital asset and cryptocurrency exchange space. Information on valuation, funding, cap tables, investors, and executives for AlphaPoint. Use the PitchBook Platform to explore the full profile. Our full-suite products provide trusted, secure, scalable, and customizable solutions for trading, payments, lending, custody, and more. AlphaPoint has enabled. AlphaPoint is a white-label software company powering crypto exchanges worldwide. Through our secure, scalable, and customizable digital asset trading. AlphaPoint is a wonderful place to work. Innovative company in an exciting space on the bleeding edge of technology. Passionate and super smart co-workers who. Find out if AlphaPoint is the right fit for your future career! Explore jobs, salary, equity, and funding information. Read about work-life balance, perks.